This post was originally published on July 1, 2016.

The one algorithm that most everyone has experience with is their credit score.

Though you don’t think of it that way, credit scores are nothing more than an algorithm at work. And what the algorithm is scoring is your reputation for credit worthiness.

The three major credit reporting agencies are:

Experian, and

These companies compile details of your credit history and have developed a formula, or algorithm, that is reflected in your credit score. That score measures the degree of risk a lender may expose themselves to when extending you credit.

FICO Score Algorithm Signals

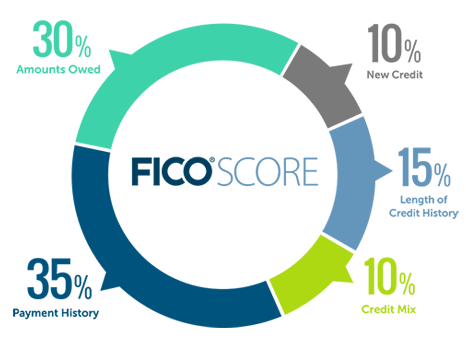

Breaking down the FICO Score will demonstrate how your credit behavior and history provide signals for the FICO Score algorithm to interpret.

This chart illustrates the credit categories FICO Score algorithm considers and the weight the algorithm puts on those categories.

There are variables that will affect the importance of these categories depending upon an individual’s current situtation. According to myFICO.com, “for some groups, the importance of these categories may vary; for example, people who have not been using credit long will be factored differently than those with a longer credit history.”

This video from the Federal Reserve Bank of St. Louis explains the FICO Score in a bit more depth:

How Signals Feed Your Credit Reputation

Credit scores provide a great introduction to the concept of the Reputation Algorithm because they are an algorithm with which everyone has some experience and familiarity.

They also illustrate how the actions you take or do not take send signals that the algoritm interprets in order to evaluate and rate your personal credit reputation.

Your reputation will be bolstered if you:

Have a long history of paying your bills on time,

Have a mix of types of credit,

Are not over-extended in total debt, and

Do not open several new credit applications over a short period of time.

Conversely, that last point can be an algorithmic signal indicating credit unworthiness and which can have a negative effect on your personal credit reputation.

For example, if you have a recent history of late payments and have more current debt than you can reasonably handle, applying for several credit cards over a short period of time can be a signal that triggers an algorithmic red flag.

Obviously, it is pretty easy to imagine that someone in that situation who applies for several new credit cards is doing so out of financial desperation.

The idea of how your behavior creates signals for algorithms to interpret is essential to understanding how the many algorithms affect what you see online (from Google search results to Amazon recommendations) and how others see you (from Facebook’s newsfeed to LinkedIn’s Who To Follow recommendations).